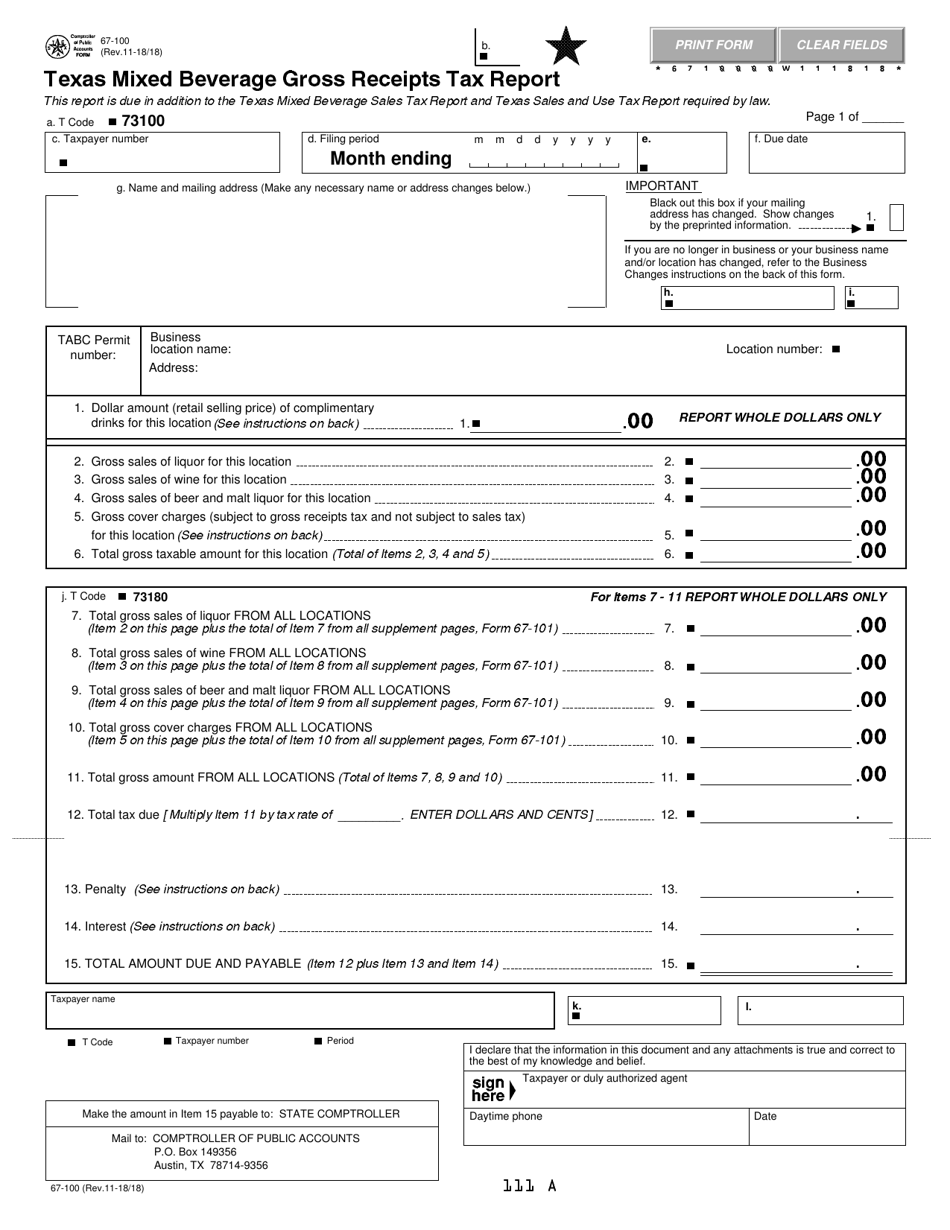

Gross receipts taxes are also taxes on sales, but unlike a general sales tax, the tax is levied on the seller rather than the consumer. What are gross receipts taxes and which states levy them? The other states that levy a gross receipts tax (Nevada, Ohio, Oregon, Tennessee, Texas, and Washington) also levy a general sales tax so revenue from both taxes are possibly included in the states' collection totals. However, Alaska allows local governments to levy their own general sales taxes, and those taxes accounted for 2 percent of its combined state and local general revenue in 2019.ĭelaware levies a gross receipts tax but Census counts its revenue as "other selective sales tax" revenue and not general sales tax revenue.

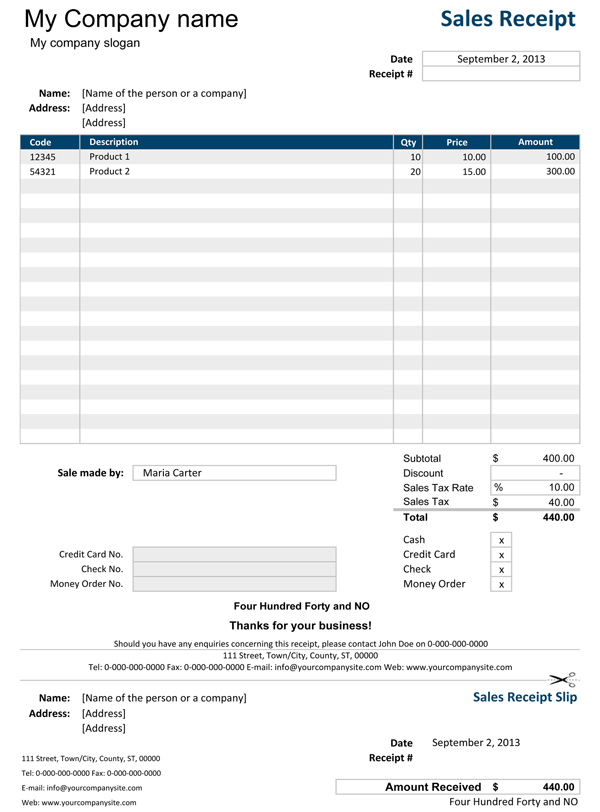

Gross receipts example download#

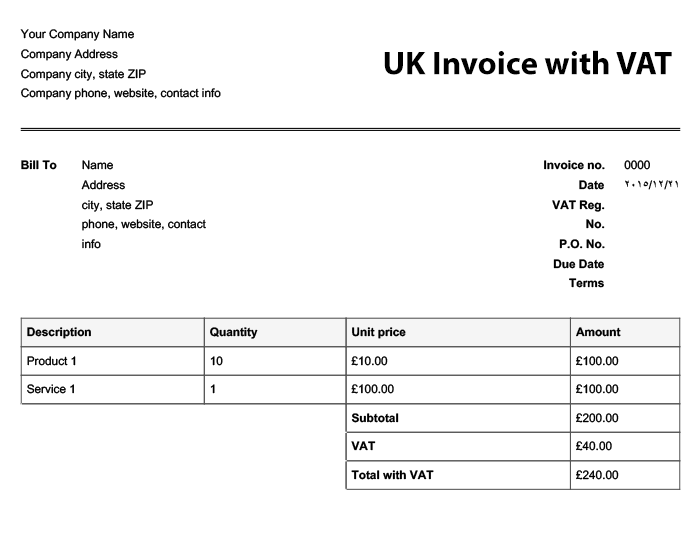

In total, 12 states with a statewide general sales tax collected less than 10 percent of state and local general revenue from the tax that year.ĭata: View and download each state's taxes as a percentage of general revenueĪlaska, Delaware, Montana, New Hampshire, and Oregon do not levy a general state sales tax. Arizona, Hawaii, and South Dakota also collected 20 percent or more of combined state and local general revenues from general sales taxes in 2019. Among the states with a statewide general sales tax, Vermont (6 percent) relied the least on general sales tax revenue in 2018. Nevada and Washington relied on general sales tax revenue more than any other state in 2019 as general sales taxes accounted for roughly a quarter of each state’s combined state and local general revenues. (For more on selective sales taxes, please see our pages on alcohol taxes, cigarette and vaping taxes, and motor fuel taxes.) By comparison, states collected $167 billion in combined selective sales taxes (8 percent) and local governments collected $38 billion (2 percent). State governments collected $334 billion (15 percent of state general revenue) from general sales taxes in 2019, while local governments collected $100 billion (5 percent of local general revenue). States rely on general sales tax revenue more than local governments. Additionally, state and local governments collected $207 billion from selective sales taxes, or 6 percent of general revenue, in 2019. General sales taxes provided less revenue than property taxes and roughly the same amount as individual income taxes. State and local governments collected a combined $434 billion in revenue from general sales taxes and gross receipts taxes, or 13 percent of general revenue, in 2019. How much revenue do state and local governments raise from general sales taxes and gross receipts taxes? Do general sales taxes apply to online purchases?.

0 kommentar(er)

0 kommentar(er)